- FourWeekMBA

- Posts

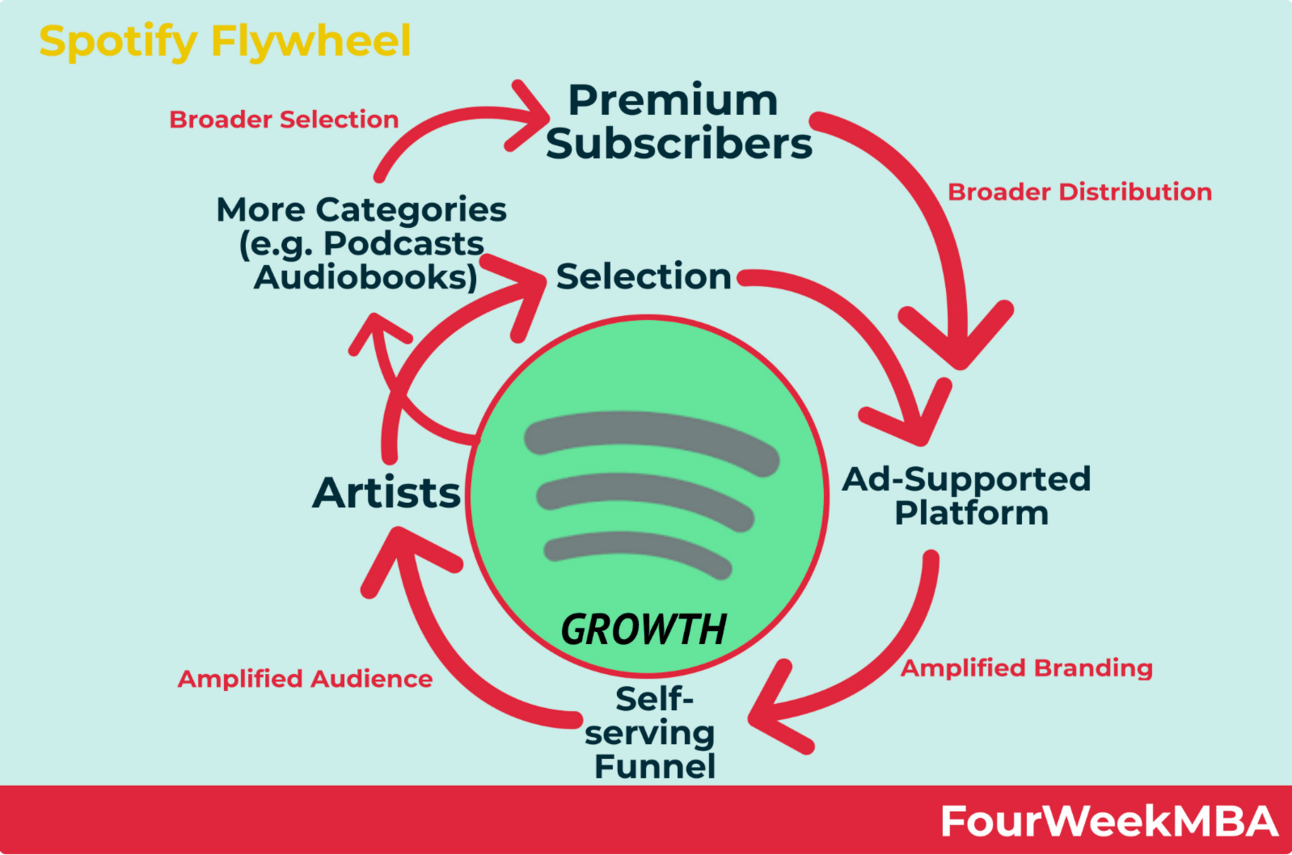

- Spotify's Flywheel

Spotify's Flywheel

Inside Spotify's Flywheel

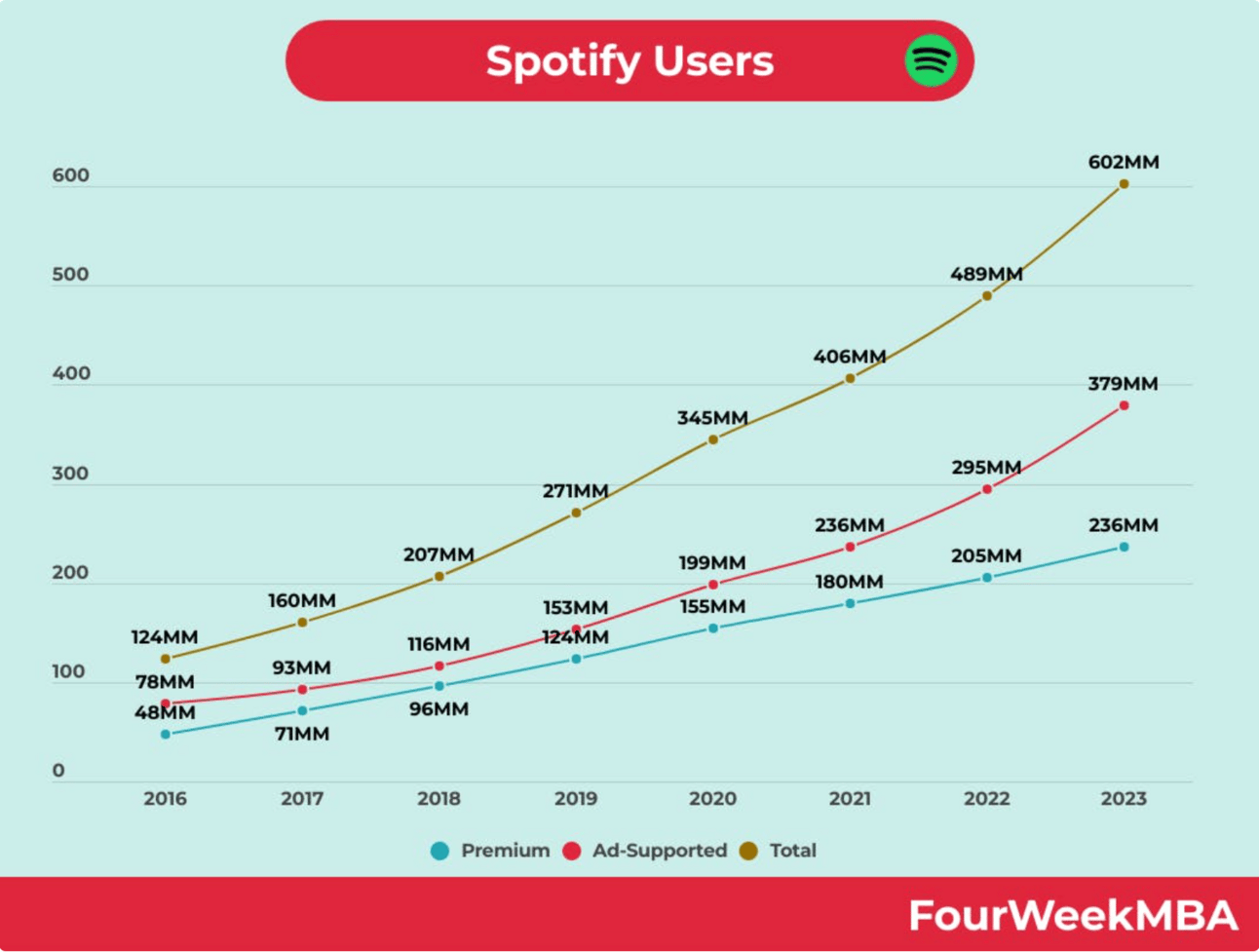

For the first time in its history, Spotify has passed 600 million subscribers.

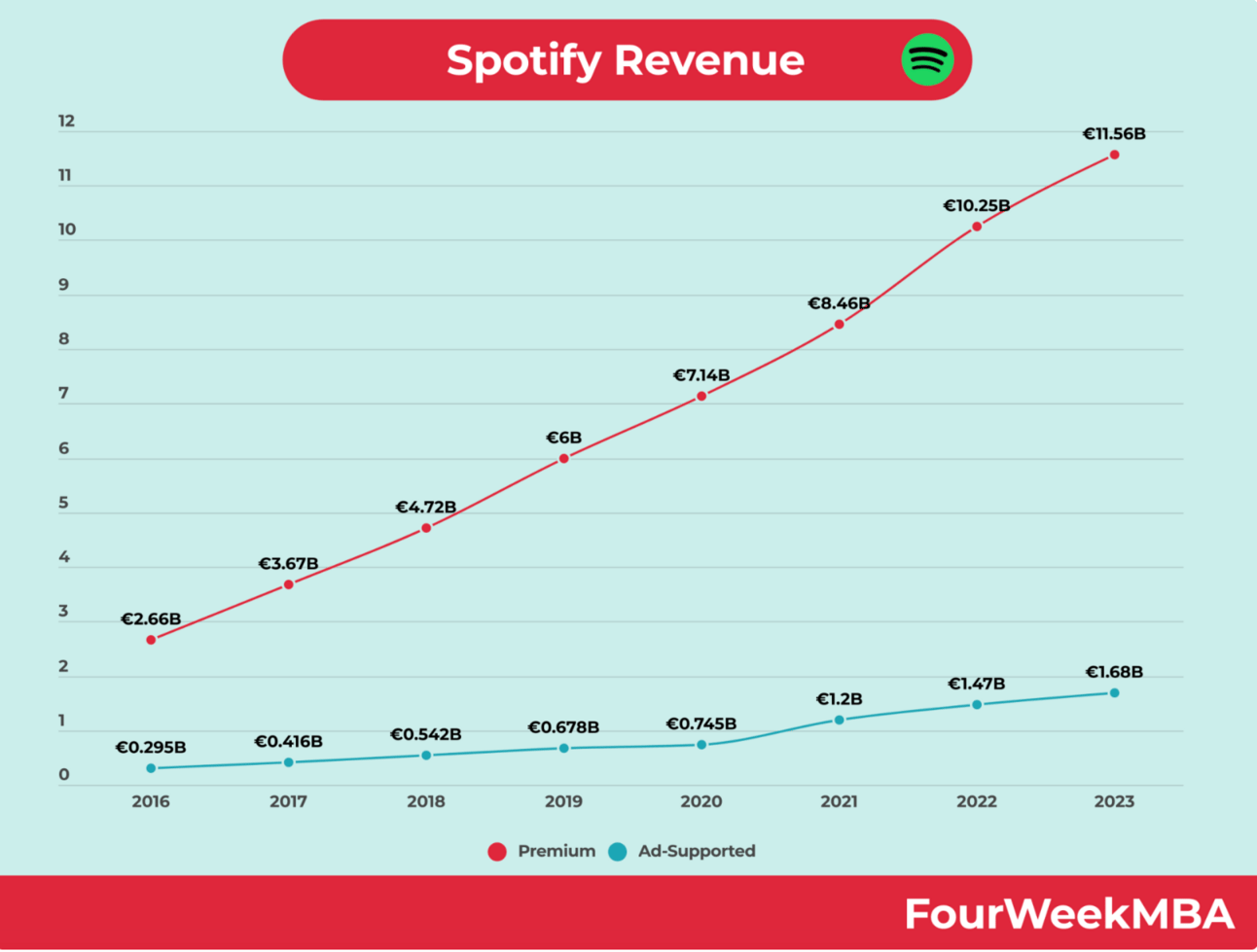

This is what it meant from a revenue standpoint.

Even though the company is still working toward its profitability.

It's also critical to look at this from another angle, less about numbers and more about branding, amplification, conversion, and automatic funneling at scale... are you ready?

Inside Spotify's funneling machine

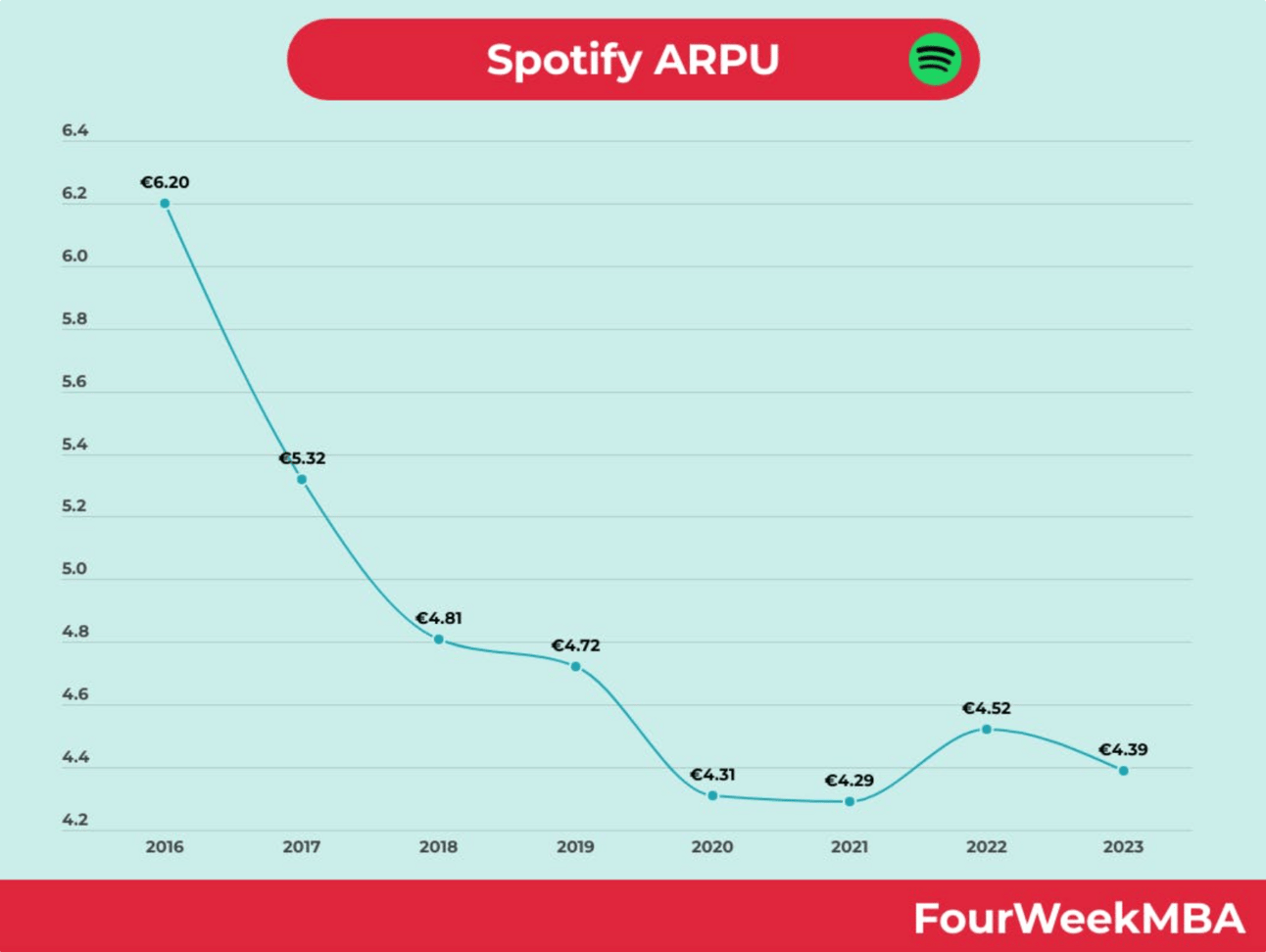

If we look at Spotify's overall ARPU, that might not be as impressive as it gets...

Indeed, if we compare Spotify's ARPU with Meta, that seems game over, but that's the wrong perspective.

Indeed, Spotify is a fundamentally different business model.

Spotify's Self-Serving Machine Combines Branding Differentiation, Distribution, Funnel Conversion & Retention!

Let's look at its cost structure. Why?

Because as soon as you zoom into it, you realize how different Spotify's business model is vs. Meta's.

Indeed, Facebook's business model is skewed toward an advertising machine, which can - asymmetrically monetize - its user base, thus making Facebook one of the most profitable (scaled) companies on earth.

When you look at the cost structure of Spotify, it shows you a completely different story.

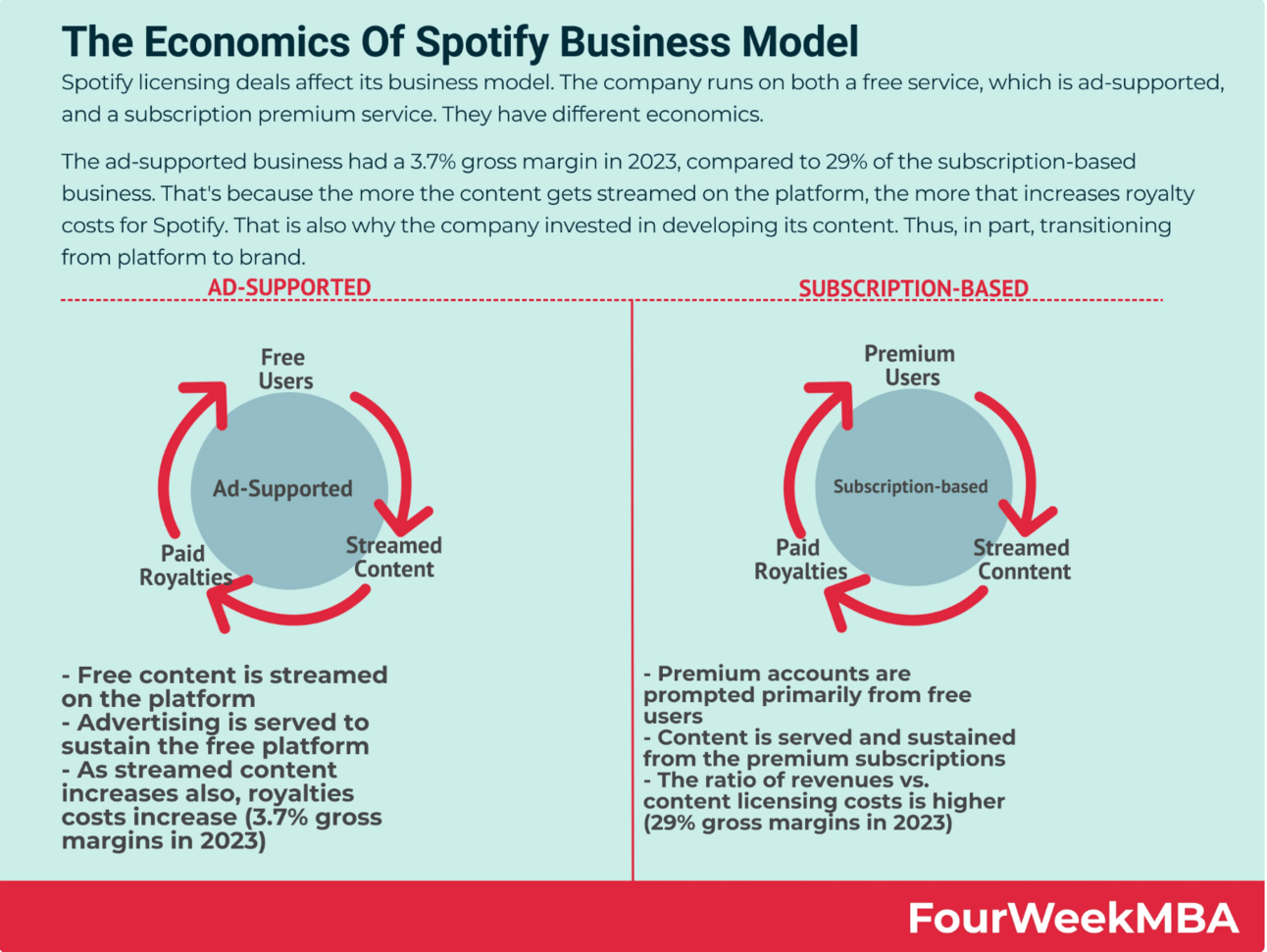

When you look at the overall economics of the Spotify business model, it has two components:

As soon as you look at it, its advertising business (contrary to Meta/Facebook) not only is run at a very tight margin, but it actually runs - almost - at a loss (if we consider all the expenses that it creates when it comes to royalties Spotify has to pay back to artists on free streams).

Let me explain...

When it comes to Spotify's cost structure, it’s worth looking at it from the following perspective:

The ad-supported business has a different cost structure than the premium business. In fact, in the ad-supported business, there is much more usage, as users can stream content for free. Thus, here, Spotify uses advertising to amortize the cost of the ad-supported side. However, the ad-supported side creates a funnel for premium users (most free users become premium subscribers over time).

The premium business, with fewer subscribers, generates many times the revenues of the ad-supported users. For instance, in 2023, the premium users generated almost seven times more revenue than the free users. Nonetheless, premium members are less than free members.

Thus, this is how the whole picture comes together:

Ad-supported: Free users get the service for free. However, they are shown in advertising and have limited functionalities. By 2023, Spotify had grown into a 379 million ad-supported user base. In short, Spotify nearly doubled its ad-supported user base in three years!

Premium: Premium users get all the content on the platform, unlimitedly, without ads, and with premium features (like skipping songs in an unlimited way). By 2023, Spotify had grown into a 236 million premium subscriber base, thus more than doubling it in five years!

In short, in terms of margins, the ad-supported business has tight margins, but it’s still critical to enhancing Spotify’s brand worldwide and enabling a self-serving conversion funnel, which channels free users into premium members.

In short, chances are that if you become a premium member (Spotify's team knows it well), you were a free member first; you will have a much lower churn than any other premium member who was not a free user before converting to premium...

Thus, framing the ad-supported business in light of the sales model, not revenues and margins, is critical.

To conclude, we should distinguish between the revenue and sales/growth models.

In fact, the ad-supported model’s aim is not just to generate revenues.

Instead, the primary goal of the ad-supported model is to enhance Spotify’s adoption and to create a self-serving funnel where free users can be triggered into a premium funnel.

Therefore, on the one hand, the ad-supported business is critical to amplifying the company’s brand.

In other words:

Ad-supported users become premium members over time, thus, nurturing Spotify's self-serving funnel.

Once ad-supported users have been converted to premium members, Spotify can retain them for a long-time. In short, the company has a very low churn rate.

By converting, Spotify is also strengthening its advertising network, thus making it possible for the ad-supported user base to generate much more revenues (at much lower costs) in the future. In short, the advertising side of the business has the ability to scale in the coming years.

In short, this is one of the most effective consumer flywheels we could find in the tech business world, which has the potential to turn Spotify toward a billion members worldwide!

And that's how it works...

In other words:

Selection of music, podcasts, and new categories (audiobooks) funnels in new free users.

These are channeled into Spotify's self-serving funnel, which also becomes appealing to artists and creators, giving them a wide audience to tap into.

This enables Spotify to invest money to improve existing categories and expand into new categories.

In turn, this also brings in more premium subscribers, thus speeding up Spotify's flywheel.

Why does it matter?

Reduced acquisition costs.

Increased brand differentiation.

Increased brand loyalty.

Conversion funneling.

Higher retention of premium members.

And this is how the whole picture comes about!

Recap: In This Issue!

Milestone Achievement: Spotify has surpassed 600 million subscribers, marking a historic achievement for the company.

Revenue Perspective: Despite the impressive subscriber count, Spotify is still working towards profitability.

Business Model Comparison: Comparing Spotify's Average Revenue Per User (ARPU) with Meta (formerly Facebook) might seem unfavorable, but it's essential to recognize the fundamental differences in their business models.

Cost Structure Analysis: Spotify's cost structure differs significantly from Meta's, with its advertising business running at tight margins and even at a loss due to royalty payments to artists for free streams.

Ad-Supported vs. Premium Business: Spotify operates both an ad-supported and premium subscription model. While the ad-supported business has tight margins, it serves as a funnel for converting free users into premium subscribers.

Growth and Retention Strategy: The ad-supported model is crucial for enhancing Spotify's brand, driving adoption, and creating a self-serving funnel to convert free users into premium subscribers.

Consumer Flywheel Effect: Spotify's business model creates a highly effective consumer flywheel, leading to reduced acquisition costs, increased brand differentiation, loyalty, and higher retention rates for premium members.

Spotify's Flywheel Explained: Spotify's strategy involves offering a wide range of content, including music, podcasts, and now audiobooks, to attract new free users. These users are then guided into Spotify's self-serving funnel, which benefits both users and creators by providing a platform with a large audience. This allows Spotify to invest in enhancing existing content categories and exploring new ones. As a result, more premium subscribers are attracted, accelerating Spotify's growth and success.

Long-Term Potential: The strategy has the potential to propel Spotify towards a billion members worldwide.

If you like these analyses, make sure to forward them to your friends and foes :)

And if you have any comments or requests for me, ping me back from here. I'll try to address them as soon as possible.

Curating this newsletter is exciting but also very challenging, so if you like it, let's make sure you support it by subscribing to its premium version (you'll get access to the whole archive!).

Related Resources:

Ciao!

With ♥️ Gennaro, FourWeekMBA