- FourWeekMBA

- Posts

- New Post

New Post

Google is the most incredible cash printing machine ever invented.

Even now, with the rise of Generative AI, Google still prints cash like never before.

For instance, in 2023, Google (Alphabet) generated over $237 billion in advertising.

And Google Search not only represented most of the advertising revenue, but it kept growing!

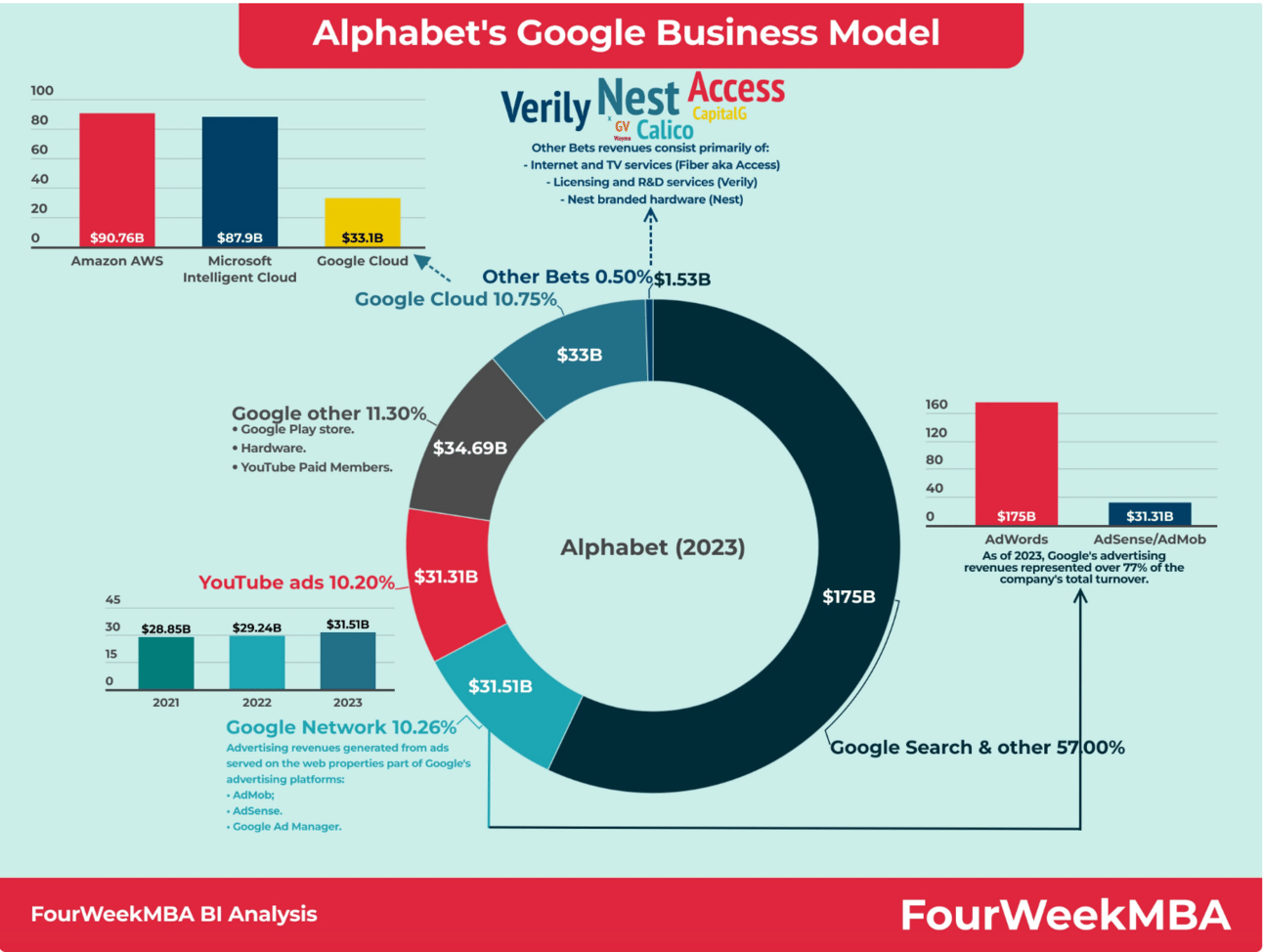

By 2023, Google Search alone generated over $175 billion in revenue, representing 57% of the company's overall net sales!

And if we look more carefully at the overall search market share in the US, Google still dominates the whole space with a solid 87.46% market share! (The US is the primary source of revenue for Google - indeed, 47% of Alphabet's revenue came from the US in 2023).

Sure, this is impressive, but before getting to any conclusion, we need to dig deeper.

Indeed, there are various angles from which we can look at this scenario to grasp what's going on.

Indeed, the fundamental matter is: is this sustainable? Is Google search still viable in the long term? Is Google's moat safe? Or will AI/AR change it all?

I'll try to address some of these topics in this newsletter, taking into account that I'm not biased in favor of or against Google.

Let's start with a simple question: Why did Google's advertising business grow massively in 2023?

This is what the overall Alphabet business model looks like in 2023-4.

In short, while Alphabet has a business model that spans many directions, close to 80% of its total revenue still comes from its advertising machine.

Alphabet, though, is way more than an advertising business.

However, the advertising unit is paying for all the significant investments that Alphabet has made and is making in various directions.

For instance, by 2023, Alphabet could afford to throw over $4 billion on its "other bets," and it has spent a combined $30 billion on these bets between 2017-2023 alone!

Could Alphabet afford such massive investments if it wasn't for its cash printing machine? (Google Search).

That's why, to understand where disruption might come from, we must first look at its cash machine: Google Search, Google Network, and YouTube.

While it's not easy at all to look under the hood of a giant advertising machine, I'll reduce the complexity of the analysis (yet without losing nuance) by asking a few very few simple questions that go at the core of the advertising business model:

Is Goolge's user base still growing?

Where is this growth coming from?

What does the advertising composition look like? In short, is Google serving more or less ads? Are those ads more or less expensive for marketers? And lastly, how is the advertising landscape changing?

What caused Google to increase its ad revenues?

By looking at the numbers for 2023, on which we have some clear sight, a few things come out:

Google search increase in paid clicks due to broader mobile adoption, cost per click, and increased volume of ads...

Google search kept printing money for three main reasons:

Increases in search queries resulting from growth in user adoption and usage on mobile devices;

Growth in advertiser spending;

Improvements in ad formats and delivery.

This means that Google is improving its ability to monetize mobile users, which keeps growing, thus also making more advertising dollars available from advertisers.

In addition to that, Google's "improvements in ad formats and delivery" simply mean that the company is pushing more and more ads on its web properties, which, while increasing monetization, might also kill UX over time.

In short, Google ads got slightly more expensive, crowded, and skewed toward mobile devices.

Google Network is fading down

One reason why Google won over anyone else in the search space was the ability to pull in publishers to primarily produce quality content that could be featured on top of its organic results.

While Google Network (the publishers that monetize their traffic via Google Ad Manager and AdSense) is also a critical revenue generator, it's a way to monitor the temperature of the overall Google ecosystem's well-being.

In the past, a decrease of 5% in Google Network impressions would have been a bit worrying. Today, with AI redefining the game, there is no doubt that Google is also trying to diversify its business model away from it.

One example is Google SGE.

While implementing SGE at scale will be tricky, this will be a crucial driver for Google's AI strategy in the coming 2-3 years.

In the meantime, we might still see a further decline in Google Network. In 2023, this decline was primarily driven by a decrease in Google Ad Manager and AdSense revenues.

YouTube

Bought for $1.6 billion in 2006, YouTube is probably one of the best business acquisitions ever performed in the business world.

For one thing, we might not have YouTube today if Google hadn't invested massive resources in making it survive, thrive, and integrate it into its advertising machine.

In 2023, YouTube passed $30 billion in advertising revenue for the first time!

Primarily driven by brand and direct response advertising products, both benefited from increased spending by advertisers willing to spend a growing pie of their marketing dollars over YouTube.

Yet, that's only part of the story. YouTube is also churning massive growth for its subscription business.

Indeed, in 2023, the Google subscriptions business grew by $5.6 billion compared to 2022, primarily driven by YouTube paid subscribers' growth!

Now that we look under the hood of Google's advertising machine let's try to address where disruption might be coming from...

Where is disruption coming from?

Let's analyze the scenario from three perspectives:

Linear competition (5-10 years): search market and mobile search.

Non-linear competition in the short term (3-5 years): mobile e-commerce.

Non-linear competition in the longer term (5-10 years): AR and Generative AI intersection.

Linear competition: Is the disruption coming from the traditional search market?

The main issue many fall into when addressing the competitive landscape for a high-tech company is to look at it from a linear perspective.

As if the main disruptor is coming from within the industry.

But that's only a very limited analysis.

While applicable in a context in which we're looking at only continuous improvements (like in the last 25 years), it won't be helpful in the case in which the whole industry is getting redefined (like it's happening to the search market since 2022, with the rise of Generative AI).

If we use the linear perspective, then, of course, Google is safe. Even its major competitor, Bing, which integrated AI into it to try to take over Google's market share, didn't go so far, and it might not go as far, at least in the next decade.

Still, by 2023, Bing managed to gain some traction, but it's still a dwarf compared to Google Search.

Of course, Microsoft is attacking from multiple directions.

With the new Bing, Edge, its hardware division, and its advertising platform (in 2021, Microsoft acquired Xandr, a digital advertising platform).

Is this enough?

Google's arbitrage machine is a combination of technology (data, algorithms, desktop and mobile platforms), product (hardware, UX, product integrations), and distribution (Chrome/Android vertical integration, deal-making, hardware), which is extremely hard to replicate at scale.

Indeed, in 2023, Google made about $4.7 for each dollar spent acquiring traffic...

That's impressive, as it shows what an efficient machine Google search is, considering its massive scale.

Can Microsoft replicate that?

Well, even if it can't, the fact that it's striking at the core of Google's business model will make it dance!

Microsoft's CEO, Satya Nadella, in an interview last year, said it clearly:

"This new Bing will make Google come out and dance, and I want people to know that we made them dance."

This is all entertaining to watch, but it's not where the real disruption comes from.

Non-Linear Competition: Mobile Ecosystem

The real deal for Google will be to adapt its whole business model for mobile and replicate the efficiency of its advertising machine for mobile UX.

While not easy to pull off, Google is successfully going in that direction.

Even though it's worth reminding that Apple is consolidating its position in the mobile ecosystem, this might make, in the next 3-5 years - as Apple's iPhone is still the major winner - the whole mobile distribution way more expensive for Google to maintain.

Thus making Apple's iOS widely grow in popularity.

While Android is still the most popular mobile operating platform worldwide, iOS is the most valuable one from a monetization standpoint!

What does that imply?

A few things:

Apple might revamp its search ambition through AI.

The company might launch new voice interfaces (much smarter than Siri).

It might also use its mobile distribution pipelines to push other mobile searches outside Google.

In short, while Google managed to stay within Apple's mobile ecosystem by paying $18 billion a year for that right, the deal might get way more expensive.

Or worse yet, Apple might resume its ambition to take over the mobile search space!

Mobile disruption

Until the 2020s, Facebook and Google were a clear duopoly.

But that's no longer the case. With new ad formats, new players have come to the space.

In addition, other players like Amazon and Apple are pushing their mobile advertising businesses.

In fact, in 2023, Apple generated over $85 billion in revenue, compared to $78 billion in 2022, and a good chunk of that growth came from its ad business...

Therefore, it's unsurprising to think of Apple's mobile ads machine as generating $20-30 billion in the coming five years.

And, if that was not enough, Amazon has aggressively entered the space with Amazon Ads, which has become a juggernaut already.

Indeed, Amazon ads are on track to become a $50 billion-a-year segment!

And if this wasn't still enough, Facebook's (Meta) ad business is closing the gap with Google Search.

This is even more interesting if we consider that Meta is also pushing new ad formats and platforms (like WhatsApp Business, which in 2023 might have already made $250 million to Meta at its launch).

In November 2023, Meta launched Flows, which enables businesses within WhatsApp to directly sell products within the chat experience, thus emulating other SuperApps - popular in China - like WeChat. |

Can Generative AI supplant search?

Here, things get pretty tricky, and I'll leave up this analysis for another day, but last year, I explained in detail how I think about it.

I'll say it more, based on the current landscape. But for sure, it's a major disruptive force, with new entrants like Perplexity AI taking (slowly then suddenly) ground off Google's search.

What's the move Google (Alphabet) should make next?

While everyone knows that Google Glasses was one of the major failures in 2012-13, only a few people know that the product was never really killed until last year...

In fact, for over a decade, Google Glasses has survived as an enterprise product.

However, Google discontinued it for good last November, as announced on its website.

Might we see a revival of that for consumers?

This might reshuffle the whole competitive landscape, propelling Google back into the game for the next 20-30 years.

Recap: In This Issue!

Financial Performance: In 2023, Alphabet reported over $237 billion in advertising revenue, with Google Search alone contributing over $175 billion, representing approximately 57% of Alphabet's total net sales. The U.S. market, where Google holds an 87.46% search market share, contributes 47% to Alphabet's revenue. This underscores Google's dominance in the search engine market and its role as a significant revenue generator for Alphabet.

Advertising Revenue Growth: The growth in Google's advertising revenue can be attributed to increased user adoption and usage on mobile devices, higher advertiser spending, and improvements in ad formats and delivery. These factors indicate Google's effective monetization strategies, particularly in capturing mobile user engagement and expanding its advertising platforms.

Diversification and Investment: Despite the heavy reliance on advertising revenue, Alphabet has diversified its business model, investing over $4 billion in "other bets" in 2023 and $30 billion from 2017 to 2023. These investments reflect Alphabet's strategy to innovate beyond its core advertising business.

YouTube's Performance: YouTube, acquired by Google in 2006, surpassed $30 billion in advertising revenue in 2023, highlighting its significant contribution to Alphabet's advertising revenue and the growing importance of video content in digital advertising.

Disruption and Competition: The analysis discusses potential disruptions and competitive threats from several angles, including:

Linear competition from traditional search engines like Bing, which, despite gaining some traction, still lags significantly behind Google in terms of distribution.

Non-linear competition from mobile e-commerce, augmented reality (AR), and generative AI could redefine user interactions and search behaviors.

Apple's increasing consolidation in the mobile ecosystem potentially challenges Google's dominance in mobile search through AI advancements and strategic investments in search capabilities.

Generative AI as a Disruptive Force: The emergence of generative AI and platforms like Perplexity AI poses a new challenge to Google's search dominance, indicating a shift in how information is searched and consumed.

Strategic Moves and Innovations: The discontinuation of Google Glasses and speculation about Alphabet's future innovations suggest ongoing efforts to explore new technologies and markets, possibly reviving or introducing new products to maintain competitive advantage.

Ciao!

With ♥️ Gennaro, FourWeekMBA